how are rsus taxed in australia

RSUs do not create a tax burden unless the stock price has changed since the RSU vested. Common tax situation and implication of RSUs In comparison to other kinds of equity compensation RSUs have a very clear tax treatment.

What Are Restricted Stock Units Rsus Openlegal

Capital gains tax is paid on RSUs when they are vested and eventually sold by the employee.

. Stock options are generally taxed at the sale while RSU stocks are. No RSUs are not taxed twice. The four taxes youll owe when you receive a paycheck or.

There are various exemptions and. At the point when RSUs vest your custodian will sell some of the stock to mitigate the taxes you owe. Nonetheless it is critical to.

RSUs in fact are taxed as soon as they vest. The first way to avoid taxes on RSUs is to put additional money into your 401k. RSUs are taxed at the.

However they are taxed differently from ordinary stock options. No matter whether you sell or hold the RSU you will be taxed on the full value. Rsus are taxed at ordinary income rates when issued typically after vesting.

Individuals must pay an income tax on the RSU as it is considered income once vested this can leaves individuals with a massive tax to pay if they enter high the highest. However as youve probably heard they can also get pretty. However as youve probably heard they can also get pretty.

Avoid Taxes on RSUs Tip 1 - Max Out Your 401k on a Pre-tax Basis. They are subject to taxation at ordinary income rates plus applicable state income tax and social security taxation. This is at least 22 which is the federal default minimum and can be as.

However an employee can defer the timing. Taxation of RSUs. RSUs will be subject to federal income tax up to a maximum rate of 37.

The gain from the sale of shares is. If desired however those with restricted stock may elect to use Section. In Australia the capital gains tax is 30.

The taxation of RSUs is a bit simpler than for standard restricted stock plans. RSU stocks dont get taxed twice. Few people understand all the various taxes that come into play when you receive a paycheck or when an RSU vests.

Compared to these other forms of equity compensation RSU taxation is pretty straightforward but does have a few unique characteristics everyone needs to understand. This creates issues for employees who therefore are taxed up front before they can realise value to settle or offset the tax liability. However it can seem like RSUs are taxed twice if you hold onto the stock and it increases in value before you sell it.

That tax bill is onerous by the way. If you sell after 30 days you will pay income tax on the value of the RSUs when they. Rsus are taxed at ordinary income rates when issued typically after vesting.

If you sell within 30 days you will pay the income tax on the value of the RSUs when you sell them. Ordinarily owners of restricted stock arent taxed on the receipt of their shares until their vesting day. Often employers will hold back an amount of shares equivalent to the tax bill upon vesting.

Restricted stock and RSUs are taxed as wages upon delivery and subject to progressive income tax up to approximately 57 percent. Because there is no actual stock issued at grant no Section 83b.

Restricted Stock Unit Rsu Tax R Ukpersonalfinance

Rsus A Tech Employee S Guide To Restricted Stock Units

How To Avoid Taxes On Rsus Equity Ftw

Tax For Expats In America In 2022 America Josh

Rsus A Tech Employee S Guide To Restricted Stock Units

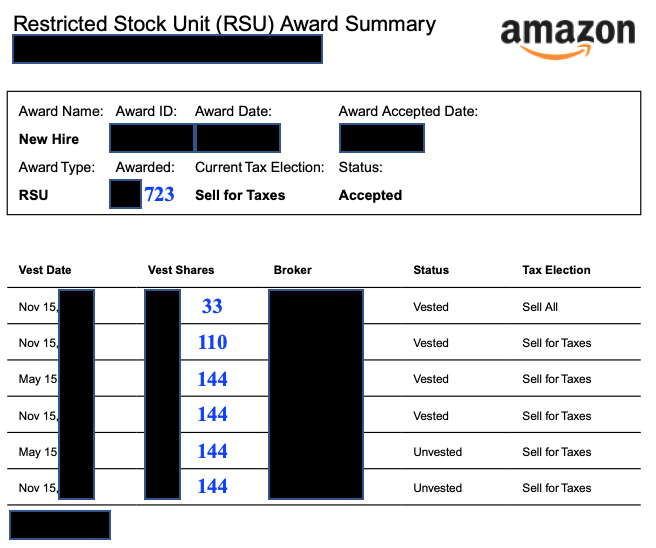

Demystifying Your Amazon Rsus Resilient Asset Management

Australia Archives The Global Equity Equation

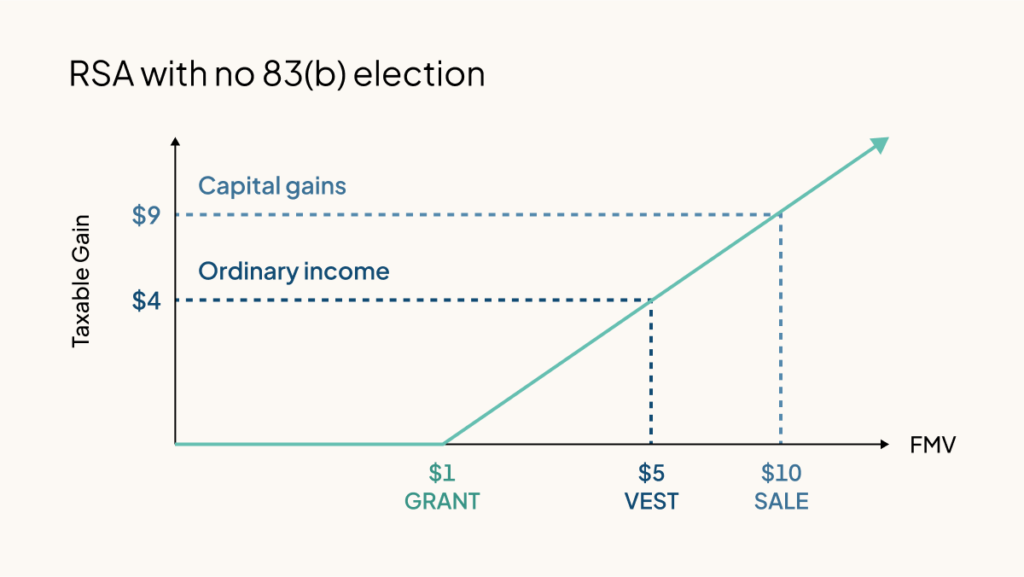

Rsa Vs Rsu What S The Difference Carta

When Do I Owe Taxes On Rsus Equity Ftw

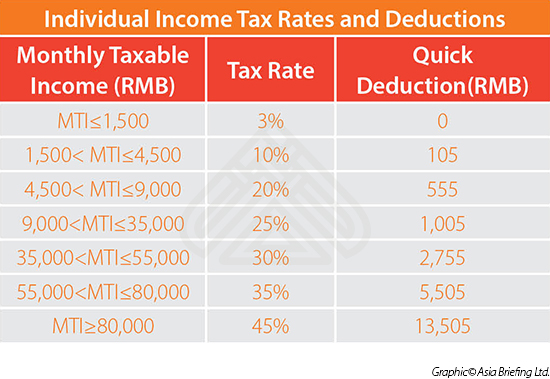

Granting Restricted Stock Units To Your Employees In China China Briefing News

Simple Tax Guide For Americans In Australia

4 Types Of Stock Awards And Their Implications For Global Executives

Rsu Tax How Are Restricted Stock Units Taxed In 2022

The Ultimate Guide To Rsu Compensation Keeping Up With The Bulls

Pros And Cons Of Restricted Stock Units Rsus

I Have Rsus But Didn T Sell Any Why Is My Tax Bill So Crazy Mana