sales tax in austin texas 2019

The State of Texas assesses a 67 gross receipts tax and an 825 sales tax on. Any sales tax collected from customers belongs to the state of Texas not you.

Apple S Billion Dollar Austin Campus Nearly Finished Move In Date Set Kxan Austin

Brownsville TX Sales Tax Rate.

. The Texas comptrollers office recently announced that they will not enforce the collection of sales tax against a remote vendor selling under 500000 a year in Texas. Avalara provides supported pre-built integration. 11 of room rate.

The State of Texas assesses a 67 gross receipts tax and an 825 sales tax on mixed beverages. The current total local sales tax rate in Austin TX is 8250. The Texas sales tax rate is currently.

To make matters worse rates in most major cities reach this limit. What is the sales tax rate in Austin Texas. Combined Area Name Local Code Rate Effective Date.

The average cumulative sales tax rate in Austin Texas is 825. 5 of gross rental receipts. Texas has a 625 statewide sales tax rate but also has 998 local tax jurisdictions including cities towns counties and special districts that collect an average local sales tax of 1684 on top of the state tax.

The State of Texas assesses a 5 prize fee on bingo winnings in excess of 5. Texas imposes a 625 percent state sales and use tax on all retail sales leases and rentals of most goods as well as taxable services. 1 of gross taxable sales.

This is the total of state county and city sales tax rates. While Texas statewide sales tax rate is a relatively modest 625 total sales taxes including county and city taxes of up to 825 are levied. 4 rows Austin TX Sales Tax Rate.

Wayfair Inc affect Texas. The minimum combined 2022 sales tax rate for Austin Texas is. The Austin sales tax rate is.

Ad Manage sales tax calculations and exemption compliance without leaving your ERP. The five states with the highest average local sales tax rates are Alabama 514 percent Louisiana 500 percent Colorado 473 percent New York 449 percent and Oklahoma 442 percent. Texas Sales Tax.

The City receives 107143 of total mixed beverage tax receipts collected in Austin. As of March 2019 sales and use tax in Texas is administered by the Texas Comptroller of Public Accounts. Sales tax revenue collected by the state of Texas in April totaled 258 billion a more than 9 drop compared to April 2019 according to a news release by the Texas comptroller of public accounts.

In Texas the combined area city sales tax is collected in addition to state tax and any other local taxes transit county special purpose district when applicable. AustinDripping Springs Library DistrictHays County. Its your responsibility to manage the taxes you collect to remain in compliance with state and local tax laws.

Dallas Houston and San Antonio all have combined state and local sales tax rates of 825 for example. 6 rows The Austin Texas sales tax is 825 consisting of 625 Texas state sales tax and. Local taxing jurisdictions cities counties special purpose districts and transit authorities can also impose up to 2 percent sales and use tax for a maximum combined rate of 825 percent.

Failure to do so can lead to penalties and. Did South Dakota v. Sales tax revenue collected by the state of Texas in April totaled 258 billion a more than 9 drop compared to April 2019 according to a news release by the Texas comptroller of public accounts.

The State of Texas assesses a 67 gross receipts tax and an 825 sales tax on mixed beverages. The County sales tax rate is. 2016 or the 2019-20 reappraisal plan by September 15 2018 pursuant to Tax Code Section 605i.

The Austin Texas sales tax is 825 consisting of 625 Texas state sales tax and 200 Austin local sales taxesThe local sales tax consists of a 100 city sales tax and a 100 special district sales tax used to fund transportation districts local attractions etc. 4431 cents per 100 of taxable value. Average local rates rose the most in Florida jumping the state from the 28th highest combined rate to the 22nd highest.

The current total local sales tax rate in Austin TX is 8250.

David Boyd Cism Cdpse Director Of Information Security And Chief Information Security Officer Texas Comptroller Of Public Accounts Linkedin

What Is The Property Tax Rate In Georgia Easyknock

Austin Property Tax What Can You Expect When Moving Here Bhgre Homecity

Austin Property Tax What Can You Expect When Moving Here Bhgre Homecity

Used Cars For Sale In Austin Tx Under 20 000 Cars Com

Best And Worst Cities For Car Lovers Gobankingrates

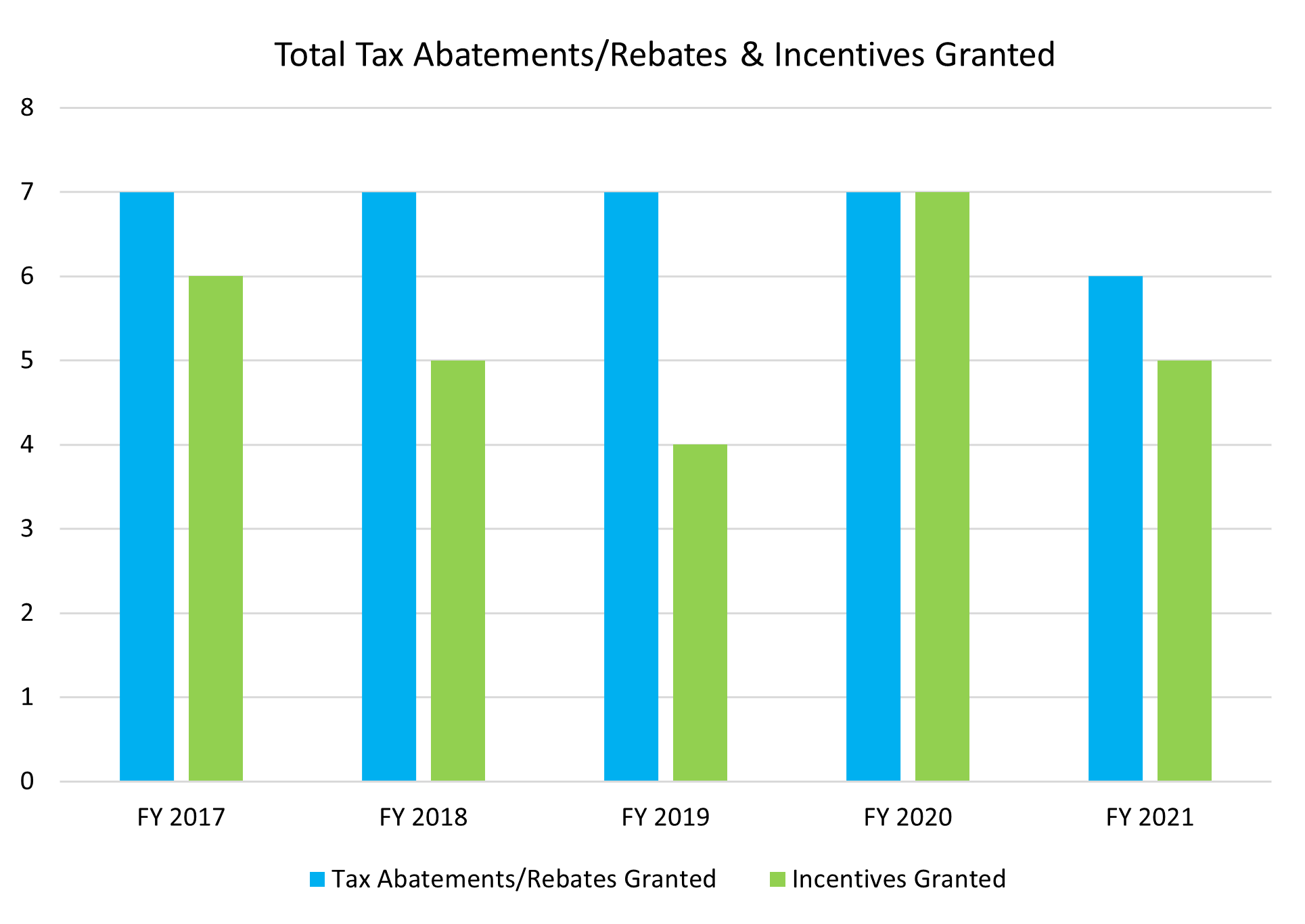

Transparency Economic Development City Of Round Rock

Austin Property Tax What Can You Expect When Moving Here Bhgre Homecity

Texas Is A Low Tax State That S A Tall Tale

Used 2018 Chevrolet Silverado 1500 For Sale Near Me Edmunds

Used Toyota Rav4 For Sale In Austin Tx Cargurus

Austin Seaholm District For Saleand Real Estate Spyglass Realty

The Ultimate Guide To Finding Office Space

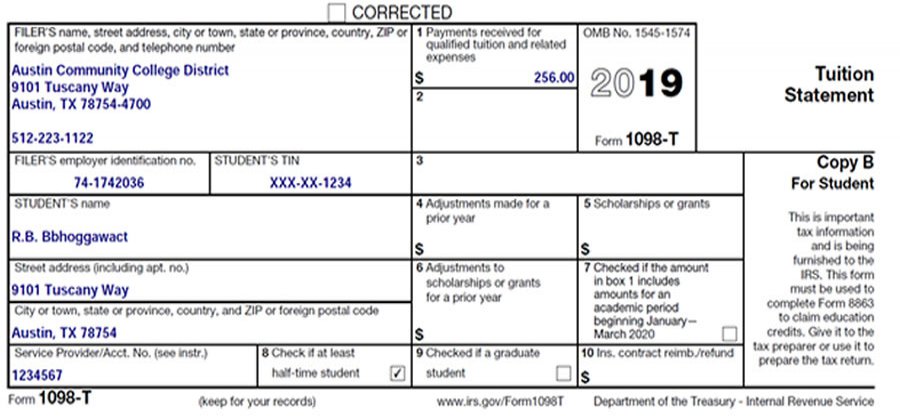

Tax Reporting 1098 T Austin Community College District

Tx Statement Of Fact To Correct Error On Title Travis County 2019 2022 Fill Out Tax Template Online Us Legal Forms

Used Gmc Sierra 1500 For Sale In Austin Tx Cargurus